Capital gains tax rates are an important consideration for every investor because you'll have to pay capital gains tax on stocks when you sell them. That's also true of other assets, as we'll see below. By understanding how these work at the federal and state levels, you can minimize your tax burden.

Capital gains taxes are also a hotly debated subject, and changes could be on the way. Some states are taking a closer look at starting capital gains taxes or raising their rates.

To provide the most recent info on capital gains taxes, we've collected data on long- and short-term capital gains tax rates, including from the IRS and in all 50 states.

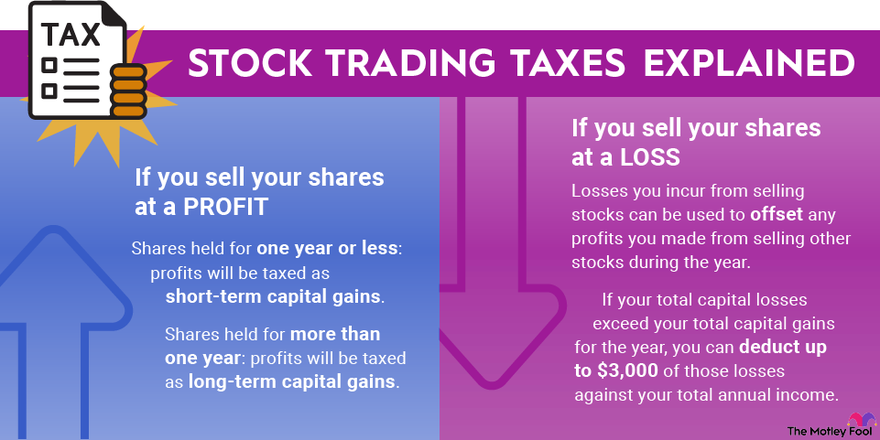

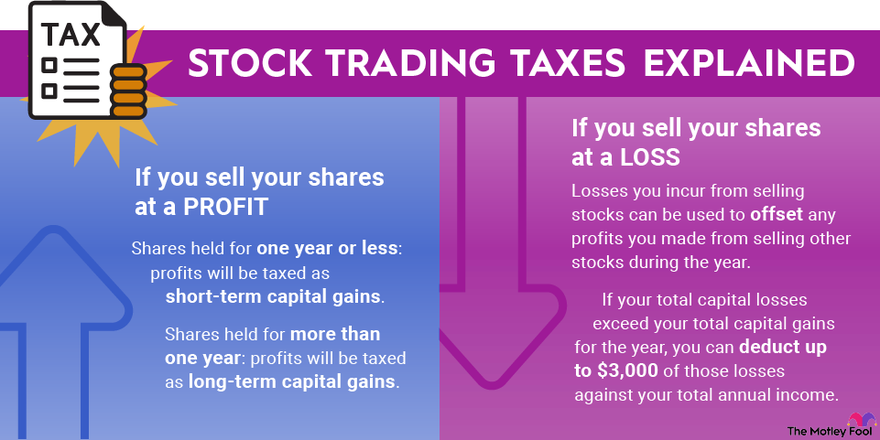

Capital gains tax is the tax you pay after selling an asset that has increased in value. Assets subject to capital gains tax include stocks, real estate, and businesses. You pay capital gains tax on the profit you made from the sale.

For example, if you buy a stock for $100 and sell it for $150, you would pay capital gains tax on $50. Capital gains are an essential part of understanding how investing and taxes work.

There are exclusions for certain types of capital gains that can lower how much you pay in taxes. The home sale exclusion is one of the most common and allows you to save on taxes when selling a house. If you've owned and used your home as your main home for at least two out of five years prior to its date of sale, you can exclude up to $250,000 in capital gains if you're a single filer or up to $500,000 if you're filing jointly with your spouse.

Short-term capital gains tax is what you pay on assets that you sell within a year. If you bought a share of Tesla (NASDAQ:TSLA) and sold it six months later, you would pay short-term capital gains tax. This type of capital gain is taxed as ordinary income.

Long-term capital gains tax is what you pay on assets that you sell after more than a year. If you bought a share of Apple (NASDAQ:AAPL) in 1995 and sold it in 2020, you would pay long-term capital gains tax.

Tax rates are lower for long-term capital gains, which is why it's generally recommended to hold assets for at least a year to minimize your taxes.

When is it time to exit your position in a stock? Consider these factors.

Interest compounds when interest payments also earn interest. Learn how to get compounding interest working for your portfolio.

Multiple index funds track the S&P 500. Which ones are the best investments for you?

The end of work doesn't mean the bills stop. How much should you save for a great retirement?

Just like income tax, you'll pay a tiered tax rate on your capital gains. For example, a single person with a total short-term capital gain of $15,000 would pay 10% of $11,600 ($1,160), then 12% on the additional $3,400 ($408), for a total of $1,568.

Federal tax rates on short-term capital gains are equal to income tax rates.

| TAX RATE | SINGLE | MARRIED FILING JOINTLY | MARRIED FILING SEPARATELY | HEAD OF HOUSEHOLD |

|---|---|---|---|---|

| 10% | Up to $11,600 | Up to $23,200 | Up to $11,600 | Up to $16,550 |

| 12% | $11,601 to $47,150 | $23,201 to $94,300 | $11,601 to $47,150 | $16,551 to $63,100 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 | $47,151 to $100,525 | $63,101 to $100,500 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 | $100,526 to $191,950 | $100,501 to $191,950 |

| 32% | $191,951 to $243,725 | $383,901 to $487,450 | $191,951 to $243,725 | $191,951 to $243,700 |

| 35% | $243,726 to $609,350 | $487,451 to $731,200 | $243,726 to $365,600 | $243,701 to $609,350 |

| 37% | Over $609,350 | Over $731,200 | Over $365,600 | Over $609,350 |

| TAX RATE | SINGLE | MARRIED FILING JOINTLY | MARRIED FILING SEPARATELY | HEAD OF HOUSEHOLD |

|---|---|---|---|---|

| 0% | Up to $47,025 | Up to $94,050 | Up to $47,025 | Up to $63,000 |

| 15% | $47,026 to $518,900 | $94,051 to $583,750 | $47,026 to $291,850 | $63,001 to $551,350 |

| 20% | Over $518,900 | Over $583,750 | Over $291,850 | Over $551,350 |

Each state has its own method of taxing capital gains. Most states tax capital gains as income. In states that do this, the state income tax applies to long- and short-term capital gains.

There are also plenty of states that handle capital gains differently. Some allow taxpayers to deduct a certain amount of capital gains. Others don't tax income or capital gains at all.

The sections below cover every state's tax laws for capital gains. They also include state income taxes for states that tax capital gains as income. Keep in mind that many states have special rules that apply to the sale of certain assets, such as exclusions for collectibles purchased before a certain year. Not every rule for every situation is included. Taxpayers should always review the capital gains rules in their state so they know about any relevant exceptions.

Alabama taxes capital gains as income, and both are taxed at the same rates.

| Tax Rate | Single | Married filing jointly | Married filing separately | Head of household |

|---|---|---|---|---|

| 2% | Up to $500 | Up to $1,000 | Up to $500 | Up to $500 |

| 4% | $501 to $3,000 | $1,001 to $6,000 | $501 to $3,000 | $501 to $3,000 |

| 5% | Over $3,000 | Over $6,000 | Over $3,000 | Over $3,000 |

Alaska does not tax personal income or capital gains.

Arizona taxes capital gains as income, and both are taxed at the same rate of 2.5%.

In Arkansas, 50% of long-term capital gains are treated as income, and both are taxed at the same rates. All short-term capital gains are treated as income, and 100% of these gains are taxed. Tax rates are the same for every filing status.

| TAX RATE | NET INCOME LESS THAN OR EQUAL TO $89,600 |

|---|---|

| 0.0% | $0 to $5,299 |

| 2.0% | $5,300 to $10,599 |

| 3.0% | $10,600 to $15,099 |

| 3.4% | $15,100 to $24,299 |

| 3.9% | $24,300 to $89,600 |

| TAX RATE | NET INCOME GREATER THAN $89,600 |

|---|---|

| 2.0% | $0 to $4,500 |

| 3.9% | $4,501 and over |

California taxes capital gains as income, and both are taxed at the same rates.

| Tax rate | Single or married filing separately | Married filing jointly | Head of household |

|---|---|---|---|

| 1% | $0 to $10,412 | $0 to $20,824 | $0 to $20,839 |

| 2% | $10,413 to $24,684 | $20,825 to $49,368 | $20,840 to $49,371 |

| 4% | $24,685 to $38,959 | $49,369 to $77,918 | $49,372 to $63,644 |

| 6% | $38,960 to $54,081 | $77,919 to $108,162 | $63,645 to $78,765 |

| 8% | $54,082 to $68,350 | $108,163 to $136,700 | $78,766 to $93,037 |

| 9.3% | $68,351 to $349,137 | $136,701 to $698,274 | $93,038 to $474,824 |

| 10.3% | $349,138 to $418,961 | $698,275 to $837,922 | $474,825 to $569,790 |

| 11.3% | $418,962 to $698,271 | $837,923 to $1,396,542 | $569,791 to $949,649 |

| 12.3% | Over $698,271 | Over 1,396,542 | Over $949,649 |

Colorado taxes capital gains as income, and both are taxed at the same rates. The state income and capital gains tax is a flat rate of 4.4%. That has been temporarily reduced to 4.25% for the 2024 tax year. This income tax reduction can also be reactivated annually for 2025 to 2035 if certain revenue triggers are met.

Connecticut taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | SINGLE OR MARRIED FILING SEPARATELY | MARRIED FILING JOINTLY | HEAD OF HOUSEHOLD |

|---|---|---|---|

| 2.0% | $0 to $10,000 | $0 to $20,000 | $0 to $16,000 |

| 4.5% | $10,001 to $50,000 | $20,001 to $100,000 | $16,001 to $80,000 |

| 5.5% | $50,001 to $100,000 | $100,001 to $200,000 | $80,001 to $160,000 |

| 6.0% | $100,001 to $200,000 | $200,001 to $400,000 | $160,001 to $320,000 |

| 6.5% | $200,001 to $250,000 | $400,001, to $500,000 | $320,001 to $400,000 |

| 6.9% | $250,001 to $500,000 | $500,001 to $1,000,000 | $400,001 to $800,000 |

| 6.99% | Over $500,000 | Over $1,000,000 | Over $800,000 |

Delaware taxes capital gains as income, and both are taxed at the same rates. Tax rates are the same for every filing status.

| TAX RATE | INCOME |

|---|---|

| 0.0% | $0 to $1,999 |

| 2.2% | $2,000 to $4,999 |

| 3.9% | $5,000 to $9,999 |

| 4.8% | $10,000 to $19,999 |

| 5.2% | $20,000 to $24,999 |

| 5.55% | $25,000 to $59,999 |

| 6.6% | $60,000 or higher |

Florida does not tax personal income or capital gains.

Georgia taxes capital gains as income, and both are taxed at the same rates. The state income and capital gains tax is a flat rate of 5.49%. If certain budget requirements are met, the tax rate will decrease by 0.10% each subsequent year until it reaches 4.99%.

Hawaii taxes capital gains at a rate of 7.25%.

Idaho taxes capital gains as income, and both are taxed at the same rates. The state income and capital gains tax is a flat rate of 5.695% for all taxpayers. The rate applies to taxable income over $2,500 for single filers and over $5,000 for married taxpayers filing jointly.

Illinois taxes capital gains as income, and both are taxed at the same rates. The Illinois state income and capital gains tax is a flat rate of 4.95%.

Indiana taxes capital gains as income, and both are taxed at the same rates. The Indiana state income and capital gains tax is a flat rate of 3.05%.

Iowa taxes capital gains as income, and both are taxed at the same rates. Tax rates are the same for every filing status.

| TAX RATE | SINGLE | MARRIED FILING JOINTLY |

|---|---|---|

| 4.40% | $0 to $6,000 | $0 to $12,000 |

| 4.82% | $6,001 to $30,000 | $12,001 to $60,000 |

| 5.70% | Over $30,000 | Over $60,000 |

Kansas taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | SINGLE, MARRIED FILING SEPARATELY, OR HEAD OF HOUSEHOLD | MARRIED FILING JOINTLY |

|---|---|---|

| 5.20% | $0 to $23,000 | $0 to $46,000 |

| 5.58% | Over $23,000 | Over $46,000 |

Kentucky taxes capital gains as income, and both are taxed at the same rates. The Kentucky state income and capital gains tax is a flat rate of 4.0%.

Louisiana taxes capital gains as income, and both are taxed at the same rates.

| Tax rate | Single, married filing separately, or head of household | Married filing jointly |

|---|---|---|

| 1.85% | $0 to $12,500 | $0 to $25,000 |

| 3.50% | $12,501 to $50,000 | $25,001 to $100,000 |

| 4.25% | Over $50,000 | Over $100,000 |

Maine taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | SINGLE OR MARRIED FILING SEPARATELY | MARRIED FILING JOINTLY | HEAD OF HOUSEHOLD |

|---|---|---|---|

| 5.80% | $0 to $26,049 | $0 to $52,099 | $0 to $39,049 |

| 6.75% | $26,050 to $61,599 | $52,100 to $123,249 | $39,050 to $92,449 |

| 7.15% | $61,600 or more | $123,250 or more | $92,450 or more |

Maryland taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | SINGLE OR MARRIED FILING SEPARATELY | MARRIED FILING JOINTLY OR HEAD OF HOUSEHOLD |

|---|---|---|

| 2.00% | $0 to $1,000 | $0 to $1,000 |

| 3.00% | $1,001 to $2,000 | $1,001 to $2,000 |

| 4.00% | $2,001 to $3,000 | $2,001 to $3,000 |

| 4.75% | $3,001 to $100,000 | $3,001 to $150,000 |

| 5.00% | $100,001 to $125,000 | $150,001 to $175,000 |

| 5.25% | $125,001 to $150,000 | $175,001 to $225,000 |

| 5.50% | $150,001 to $250,000 | $225,001 to $300,000 |

| 5.75% | Over $250,000 | Over $300,000 |

Massachusetts taxes both income and most long-term capital gains at a flat rate of 5%. Short-term capital gains are taxed at 8.5%.

Michigan taxes capital gains as income, and both are taxed at the same rates. The Michigan state income and capital gains tax is a flat rate of 4.25%.

Minnesota taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | SINGLE | MARRIED FILING JOINTLY | MARRIED FILING SEPARATELY | HEAD OF HOUSEHOLD |

|---|---|---|---|---|

| 5.35% | $0 to $31,690 | $0 to $46,330 | $0 to $23,165 | $0 to $39,010 |

| 6.80% | $31,691 to $104,090 | $46,331 to $184,040 | $23,166 to $92,020 | $39,011 to $156,760 |

| 7.85% | $104,091 to $193,240 | $184,041 to $321,450 | $92,021 to $160,725 | $156,761 to $256,880 |

| 9.85% | Over $193,240 | Over $321,450 | Over $160,725 | Over $256,880 |

Mississippi taxes capital gains as income, and both are taxed at the same rates.

| Tax Rate | Income |

|---|---|

| 0% | $0 to $10,000 |

| 4.7% | Over $10,000 |

Income over $10,000 will be taxed in Mississippi as follows:

Missouri taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | INCOME |

|---|---|

| 0.0% | $0 to $1,273 |

| 2.0% | $1,274 to $2,546 |

| 2.5% | $2,547 to $3,819 |

| 3.0% | $3,820 to $5,092 |

| 3.5% | $5,093 to $6,365 |

| 4.0% | $6,366 to $7,638 |

| 4.5% | $7,639 to $8,911 |

| 4.8% | Over $8,911 |

Montana has capital gains tax rates of 3.0% to 4.1% depending on the amount of capital gains minus ordinary income.

| TAX RATE | SINGLE | MARRIED FILING JOINTLY | MARRIED FILING SEPARATELY | HEAD OF HOUSEHOLD |

|---|---|---|---|---|

| 3.0% | $0 to $20,499, minus ordinary income | $0 to $40,999, minus ordinary income | $0 to $20,499, minus ordinary income | $0 to $30,749, minus ordinary income |

| 4.1% | $20,500 or more, minus ordinary income | $41,000 or more, minus ordinary income | $20,500 or more, minus ordinary income | $30,750 or more |

Nebraska taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | SINGLE OR MARRIED FILING SEPARATELY | MARRIED FILING JOINTLY | HEAD OF HOUSEHOLD |

|---|---|---|---|

| 2.46% | $0 to $3,900 | $0 to $7,790 | $0 to $7,270 |

| 3.51% | $3,901 to $23,370 | $7,791 to $46,760 | $7,271 to $37,400 |

| 5.01% | $23,371 to $37,760 | $46,761 to $75,340 | $37,401 to $55,850 |

| 5.84% | Over $37,760 | Over $75,340 | Over $55,850 |

Nevada does not tax personal income or capital gains.

New Hampshire does not tax personal income or capital gains.

New Jersey taxes capital gains as income, and both are taxed at the same rates.

| Tax rate | Single and married filing separately |

|---|---|

| 1.400% | $0 to $20,000 |

| 1.750% | $20,001 to $35,000 |

| 3.500% | $35,001 to $40,000 |

| 5.525% | $40,001 to $75,000 |

| 6.370% | $75,001 to $500,000 |

| 8.970% | $500,001 to $1,000,000 |

| 10.750% | Over $1,000,000 |

| TAX RATE | MARRIED FILING JOINTLY AND HEAD OF HOUSEHOLD |

|---|---|

| 1.400% | $0 to $20,000 |

| 1.750% | $20,001 to $50,000 |

| 2.450% | $50,001 to $70,000 |

| 3.500% | $70,001 to $80,000 |

| 5.525% | $80,001 to $150,000 |

| 6.370% | $150,001 to $500,000 |

| 8.970% | $500,000 to $1,000,000 |

| 10.750% | Over $1,000,000 |

New Mexico taxes capital gains as income, and both are taxed at the same rates. The state allows filers to deduct either 40% of capital gains income or $1,000, whichever is greater.

| Tax rate | Single | Married filing jointly or head of household | Married filing separately |

|---|---|---|---|

| 1.7% | $0 to $5,500 | $0 to $8,000 | $0 to $4,000 |

| 3.2% | $5,501 to $11,000 | $8,001 to $16,000 | $4,001 to $8,000 |

| 4.7% | $11,001 to $16,000 | $16,001 to $24,000 | $8,001 to $12,000 |

| 4.9% | $16,001 to $210,000 | $24,001 to $315,000 | $12,001 to $157,500 |

| 5.9% | Over $210,000 | Over $315,000 | Over $157,500 |

New York taxes capital gains as income, and both are taxed at the same rates.

| Tax rate | Single or married filing separately | Married filing jointly | Head of household |

|---|---|---|---|

| 4.00% | $0 to $8,500 | $0 to $17,150 | $0 to $12,800 |

| 4.50% | $8,501 to $11,700 | $17,151 to $23,600 | $12,801 to $17,650 |

| 5.25% | $11,701 to $13,900 | $23,601 to $27,900 | $17,651 to $20,900 |

| 5.85% | $13,901 to $80,650 | $27,901 to $161,550 | $20,901 to $107,650 |

| 6.25% | $80,651 to $215,400 | $161,551 to $323,200 | $107,651 to $269,300 |

| 6.85% | $215,401 to $1,077,550 | $323,201 to $2,155,350 | $269,301 to $1,616,450 |

| 9.65% | $1,077,551 to $5,000,000 | $2,155,351 to $5,000,000 | $1,616,451 to $5,000,000 |

| 10.30% | $5,000,001 to $25,000,000 | $5,000,001 to $25,000,000 | $5,000,001 to $25,000,000 |

| 10.90% | Over $25,000,000 | Over $25,000,000 | Over $25,000,000 |

North Carolina taxes capital gains as income, and both are taxed at the same rates. The North Carolina state income and capital gains tax is a flat rate of 4.5% for the 2024 tax year. It will decrease to 4.25% in 2025 and then to 3.99% for subsequent tax years.

North Dakota taxes capital gains as income, and both are taxed at the same rates. The state allows filers to deduct 40% of capital gains income.

| TAX RATE | SINGLE | MARRIED FILING JOINTLY | MARRIED FILING SEPARATELY | HEAD OF HOUSEHOLD |

|---|---|---|---|---|

| 0.00% | $0 to $47,150 | $0 to $78,775 | $0 to $39,375 | $0 to $63,175 |

| 1.95% | $47,151 to $238,200 | $78,776 to $289,975 | $39,376 to $144,975 | $63,176 to $264,100 |

| 2.5% | Over $238,200 | Over $289,975 | Over $144,975 | Over $264,100 |

Ohio taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | INCOME |

|---|---|

| 0.00% | 0 to $26,050 |

| 2.75% | $26,051 to $100,000 |

| 3.50% | Over $100,000 |

Oklahoma taxes capital gains as income, and both are taxed at the same rates. Taxpayers can deduct 100% of their capital gains resulting from

| TAX RATE | SINGLE OR MARRIED FILING SEPARATELY | MARRIED FILING JOINTLY OR HEAD OF HOUSEHOLD |

|---|---|---|

| 0.00% | $0 to $6,350 | $0 to $12,700 |

| 0.25% | $6,351 to $7,350 | $12,701 to $14,700 |

| 0.75% | $7,351 to $8,850 | $14,701 to $17,700 |

| 1.75% | $8,851 to $10,100 | $17,701 to $20,200 |

| 2.75% | $10,101 to $11,250 | $20,201 to $22,500 |

| 3.75% | $11,251 to $13,550 | $22,501 to $27,100 |

| 4.75% | Over $13,551 | Over $27,100 |

Oregon taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | SINGLE OR MARRIED FILING SEPARATELY | MARRIED FILING JOINTLY OR HEAD OF HOUSEHOLD |

|---|---|---|

| 4.75% | $0 to $4,300 | $0 to $8,600 |

| 6.75% | $4,301 to $10,750 | $8,601 to $21,500 |

| 8.75% | $10,751 to $125,000 | $21,501 to $250,000 |

| 9.90% | Over $125,000 | Over $250,000 |

Pennsylvania taxes capital gains as income, and both are taxed at the same rates. The Pennsylvania state income and capital gains tax is a flat rate of 3.07%.

Rhode Island taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | INCOME |

|---|---|

| 3.75% | $0 to $77,450 |

| 4.75% | $77,451 to $176,050 |

| 5.99% | Over $176,050 |

South Carolina taxes capital gains as income, and both are taxed at the same rates. On long-term capital gains, taxpayers are allowed a deduction of 44%.

| TAX RATE | INCOME |

|---|---|

| 0% | $0 to $3,459 |

| 3% | $3,460 to $17,329 |

| 6.2% | $17,330 and up |

South Dakota does not tax personal income or capital gains.

Tennessee does not tax personal income or capital gains.

Texas does not tax personal income or capital gains.

Utah taxes capital gains as income, and both are taxed at the same rates. The Utah state income and capital gains tax is a flat rate of 4.55%.

Vermont taxes short-term capital gains and long-term capital gains held for up to three years as income, and these are all taxed at the same rates. Taxpayers are allowed to exclude up to 40% of capital gains or a flat exclusion of $5,000 on assets held longer than three years. This exclusion amount is capped at $350,000 and cannot exceed 40% of federal taxable income.

| TAX RATE | SINGLE | MARRIED FILING JOINTLY | MARRIED FILING SEPARATELY | HEAD OF HOUSEHOLD |

|---|---|---|---|---|

| 3.35% | $0 to $45,400 | $0 to $75,000 | $0 to $37,925 | $0 to $60,850 |

| 6.60% | $45,401 to $110,050 | $75,001 to $183,400 | $37,926 to $91,700 | $60,851 to $157,150 |

| 7.60% | $110,051 to $229,550 | $183,401 to $279,450 | $91,701 to $139,725 | $157,151 to $254,500 |

| 8.75% | Over $229,550 | Over $279,450 | Over $139,725 | Over $254,500 |

Virginia taxes capital gains as income, and both are taxed at the same rates.

| TAX RATE | INCOME |

|---|---|

| 2.00% | $0 to $3,000 |

| $60 + 3.00% in bracket | $3,001 to $5,000 |

| $120 + 5.00% in bracket | $5,001 to $17,000 |

| $720 + 5.75% in bracket | Over $17,000 |

Washington imposes a 7% tax on long-term capital gains above $262,000.

West Virginia taxes capital gains as income, and both are taxed at the same rates.

| Tax Rate | Single | Married filing separately |

|---|---|---|

| 2.36% | $0 to $10,000 | $0 to $5,000 |

| 3.15% | $10,001 to $25,000 | $5,001 to $12,500 |

| 3.54% | $25,001 to $40,000 | $12,501 to $20,000 |

| 4.72% | $40,001 to $60,000 | $20,001 to $30,000 |

| 5.12% | Over $60,000 | Over $30,000 |

Wisconsin taxes capital gains as income, and both are taxed at the same rates. On long-term capital gains, taxpayers are allowed a deduction of 30%, or 60% if the capital gain resulted from the sale of farm assets.

| TAX RATE | SINGLE OR HEAD OF HOUSEHOLD | MARRIED FILING JOINTLY | MARRIED FILING SEPARATELY |

|---|---|---|---|

| 3.50% | $0 to $14,320 | $0 to $19,090 | $0 to $9,550 |

| 4.40% | $14,321 to $28,640 | $19,091 to $38,190 | $9,551 to $19,090 |

| 5.30% | $28,641 to $315,310 | $38,191 to $420,420 | $19,091 to $210,210 |

| 7.65% | Over $315,310 | Over $420,420 | Over $210,210 |

Wyoming does not tax personal income or capital gains.

The lion's share of taxes, including personal income and capital gains taxes, go to the federal government. But each taxpayer's state also determines how much they owe on their capital gains. It's important for taxpayers to know the capital gains tax brackets and exclusions in their respective states so they pay the correct amount.

Are there signs that capital gains taxes will be increased to balance the federal debt incurred by issuing stimulus payments?

Before there were stimulus checks, candidate Joe Biden expressed support for eliminating (1) the capital gain preference for higher-income people (so that capital gains would be taxed at the same rates as ordinary income for taxpayers with more than $1 million in income) and (2) the fair-market-basis rule that applies to property transferred at death.

(The latter is often referred to as the step-up-in-basis rule—although it can work to step-down basis as well -- in that any appreciation in the value of property transferred at death permanently disappears from the income-tax base.)

President Biden is expected to include those proposals in a package to be announced next week. He can’t make these changes on his own, however, and I’m not very good at predicting what Congress will do. With both the House and Senate closely divided, congressional approval might be iffy. I’m pretty sure Republicans in Congress would unanimously disapprove of these changes, and I’m skeptical that Democrats would all approve.

(The changes would in form directly affect only the well-to-do, but there is always the possibility -- maybe even the likelihood -- of spillover effects on lower-income persons.)

If the government expresses interest in raising capital gains taxes, could we see a stock sell-off in response? How might that affect the greater economy?

I have little doubt that there would be a sell-off in anticipation of a rate increase, particularly if the rate increase is coupled with elimination of the step-up-in-basis rule (which has provided an incentive to hold on to appreciated property longer than might otherwise be economically desirable).

(I’m assuming that any rate increases won’t be retroactive and that taxpayers will have time to sell assets while lower rates remain in effect.)

I’m not an economist, and I don’t have a reasoned opinion about the effects on the economy. However, one interesting point is that, if a sell-off occurs, tax revenues might actually go up in the short run, while the lower rates remain in effect. More sales would mean that what would otherwise have been unrealized (and therefore currently untaxed) appreciation would become realized (and therefore taxable) appreciation.

When higher rates then go into effect, one would anticipate fewer sales of capital assets. Unsold appreciated assets don’t generate income-tax revenue, and higher rates therefore don’t necessarily mean higher tax revenues.

Do you foresee the elimination of 0% capital gains tax rates? How many people might be affected by this, and how might that affect long-term participation in the markets?

If the president really supports an increase in the capital gains rate only for higher-income persons, the 0% rate should remain.

(In addition, the 100% exclusion for gain on the sale of qualified small business stock under section 1202 -- which has the effect of a 0% rate on such gain, even for high-income taxpayers -- doesn’t seem to be on the chopping block. And a 0% rate always applies to appreciation that isn’t realized -- i.e., if the taxpayer doesn’t sell the appreciated asset.)

I’m not sure how many taxpayers benefit from the 0% rate. Direct ownership of stock by individuals is concentrated among higher-income people. The stock market can affect the value of lower-income peoples’ retirement funds, of course, but those funds would generally not be taxable entities.